safe owner financing

Book a Consultation to Discuss Protections, Numbers, and Closing Steps

Seller Benefits

Net More Money

Create more demand for your property by offering finance terms that are more attractive than traditional bank loans.

Passive Monthly Income

Convert the equity and/or your existing loan into consistent cash flow without the burden of repairs, taxes, insurance and HOA costs.

Tax Advantages

Take advantage of potential tax savings when the sale of your property triggers a taxable profit. Always consult a tax professional.

Frequently Asked Questions

How is the sale structured?

To ensure maximum protection for the seller/lender and the buyer/borrower, a trust will be created to hold title of the property. This trust protects the underlying loan and maintains clear title until the seller's loan is paid off or replaced with a new loan. Additionally, a third-party servicing company is put in place to collect and pay loan payments, property taxes, and insurance (if necessary). The title-holding trust, trustee, documents, and third-party servicing company all serve to monitor and enforce these protections.

How long does it take to close?

Closing can occur within 10 days after the inspection period is complete. Once all parties agree on terms, we will produce the purchase documents which include a physical inspection period as well as a document review period, typically between 5 to 10 calendar days. Since there is no loan commitment required by the buyer, there is no finance contingency in the purchase documents so the buyer's deposit will become non-refundable after the inspection period is over. Closing can then occur within 7 to 10 days, after necessary title work is complete.

What are the steps (sale and closing process)?

Step 1: Seller Consultation - Owner-finance terms are structured on a seller consultation. MLS is updated accordingly, with TTC guidance.

Step 2: Buyer Consultation - Interested buyer (and their agent) book a TTC consultation to discuss structure, terms, and closing steps.

Step 3: Purchase Documents Sent - Upon mutual agreement of terms, the deal info is submitted (link at the top of this page) so TCC can produce purchase documents for all parties to sign.

Step 4: Due Diligence Period - Once purchase docs are signed, TTC's Transaction Coordinator will get in touch with everyone and walk them through closing steps, starting with completion of the buyer's inspection period, if any, along with submission of the buyer's earnest deposit to the title company. During this due diligence period, a lender can vet the buyer/borrower if required by the seller.

Step 5: Closing Preparation - After completion of the due diligence (inspection) period, Title will conduct necessary title searches and issue a title insurance policy for the title holding trust. At the same time, the trustee will produce trust documents for the closing package.

Step 6: Closing - Closing is scheduled and done, typically, by mobile notary at a time/place that is convenient for each party.

Does the Buyer go through underwriting (credit check, income verification)?

This is optional for sellers. A healthy down payment (15% to 25%) can be sufficient "security" for sellers offering financing for buyers. If a seller chooses, they can conduct their own credit check and income verification during the due diligence period, after purchase documents are signed. Many sellers will simply require the buyer to do an informal pre-approval with a lender to ensure the buyer is capable of securing a new loan (refinance) at the end of the balloon period.

What are the seller's closing costs?

There is no standard, as all costs are negotiable between buyers and sellers. That said, in most cases, the costs that typically come out of the seller's down payment proceeds is the commission(s) and about $2,100 for the trust documents. Scenario: Buyer pays seller $100,000 down payment. Seller pays $20,000 commission plus $2,100 trust docs for a total of $22,100 in total costs, netting the seller $77,900 at closing.

What are the buyer's closing costs?

Closing costs for the buyer include a title policy for the trust (calculated based on sale price), TTC's 1% to 2% consultation fee (1% if the buyer's agent is a Performance-First Advisory member), and title search/closing/recording fees (approximately $1,950). As an example, the total cash to close a $500,000 purchase would be about $9,525 plus the seller's down payment (typically ranging from 15% to 25% of the sale price). NOTE: Closing costs vary by state.

What are the finance terms typically offered to buyers?

All purchase and loan terms are negotiable, but the following loan terms are typical: 15% to 20% down payment; interest rate between 4% and 6%, loan amortization (for the sake of calculating the monthly payment) is 30 years; and the balloon payment (loan end date) ranges between 5 years and 10 years. Each seller's situation and timing will dictate how we suggest framing your loan terms to potential buyers.

Who pays taxes, insurance, HOA, and maintenance?

Just like any real estate sale, the buyer will cover the cost of all expenses related to the subject property (repairs, upkeep, utilities, property taxes, insurance, HOA/COA).

Can a buyer homestead the subject property?

Yes. The buyer/borrower enjoys all the benefits of homeownership, homestead tax status included. Obviously, this only applies to buyers who occupy the subject property as their primary residence.

Can a buyer sell or refinance the property at any time?

Yes. Buyers retain the right to sell or refinance anytime. In most cases, sellers do not add a prepayment penalty in the loan terms, although, this is negotiable, too.

How is the seller protected if the buyer defaults?

The buyer does not get title until the loan is paid off (typically refinanced), which means a costly foreclosure - the typical resolution for loans secured by a mortgage or deed of trust - is not required. Per the language in the title-holding trust documents, the buyer will lose their deposit and controlling interest of the trust (and the subject property) if the default is not cured within 60 days.

How are monthly payments collected and disbursed?

A third-party loan servicer will handle all collections and disbursements. As such, sellers and buyers never interact after closing. The loan servicer serves to automate payments and protect the underlying loan, if applicable.

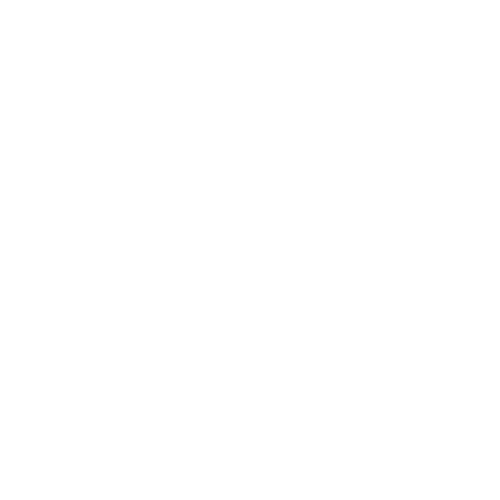

How is the monthly payment calculated?

The payment depends on the purchase price, down payment, interest rate, and amortization period. These terms are negotiable between the buyer and seller.

How long does a seller have to wait for the balance of their equity?

The loan term is negotiable, usually between 3 years and 30 years. While the monthly payment is usually calculated based on a 30-year payoff (amortization), sellers can dictate when the loan balance must be paid off ("balloon period" or "maturity date").

Does a seller need to own their property free and clear?

No. If the seller has an existing home loan, that loan will remain in place and, in most cases, the new loan offered to the buyer is "wrapped around" the underlying loan. A third-party servicing company will facilitate the automatic collection and disbursements for both loans. This will make more sense during the consultation when we go over the numbers.

If a seller keeps their existing loan in place, how will owner-financing affect their next home loan?

In the overwhelming majority of cases, the trust structure does not affect a seller's ability to qualify for their next home loan. We will ensure a seller qualifies for owner-financing before moving forward if this is the seller's scenario. In situations where a seller is applying for a loan on their next purchase, we will coordinate with the seller's loan officer.

Agents: Download your TTC Owner Finance Toolkit and help more clients get to the closing table as an owner finance specialist.

We believe that homeownership should be accessible to everyone!

Nate Samson

Owner Finance Specialist

Nate Samson

Owner Finance Specialist

At Terms That Close, we believe every real estate transaction should lead to peace—not pressure.

Isaiah 32:18 says, "My people will live in peaceful dwelling places, in secure homes, in undisturbed places of rest."

Enter MISSION 3218, our aim to help 3,218 buyers and sellers close with protected owner finance terms.

That’s not just a spiritual vision—it’s a real possibility when buyers and sellers work together instead of relying on banks that often make things harder and more costly than they need to be.

We're in a shifting market. Sellers are facing more competition and longer listing times. Buyers are fighting rising rates and tighter lending standards. But there's a better way.

Our mission is simple:

Put the power back in your hands.

We show sellers how to turn their homes into income-producing assets with owner financing, and we help buyers lock in homes they love without having to jump through bank hoops. Everybody wins.

Whether you're trying to sell quickly or buy smart, we’ll guide you through creative, secure, and ethical strategies that close deals and create long-term peace—for both sides.

This is more than financing. It’s freedom.

It’s Terms That Close.

Copyright - All Rights Reserved